How To Start The 1031 Tax-Deferred Exchange Process

The Basics

Section 1031 of the Internal Revenue Code of 1986, as amended, permits a Taxpayer to relinquish (transfer) property held for “productive use in a trade or business” or for “investment” in exchange for a “like-kind” replacement property which is intended to be held for “productive use in a trade or business” or for “investment.” Real estate may be exchanged for like-kind real estate, and personal property may be exchanged for like-kind personal property. Real estate may not be exchanged for personal property.

Some definition of terms:

- Relinquished Property: the property(ies) you want to Exchange (sell).

- Replacement Property: the property(ies) you want to Exchange into (buy).

- Closing agent: the person or entity that is processing your closing, such as: attorney, escrow, or title company.

- Exchangor/Taxpayer: the person or entity doing the Exchange (you).

- Accommodator/Qualified Intermediary: (or “QI”) the firm handling your 1031 exchange transaction (i.e., Exchange Solutions Group, LLC).

The world of like-kind real estate is broad and almost limitless. The only real restrictions are exchanging out of or into (1) a Taxpayer’s principal residence; (2) a Taxpayer’s second or vacation home (with some wiggle room); or (3) property held for sale (inventory, property flipping, etc.). Real estate that qualifies can be a residential rental property; an office building, a shopping center, a NNN property (i.e., McDonalds or CVS), an oil and gas lease, a lease with at least 30 years remaining on its term; vacant land, etc., as long as they are held for “productive use in a trade or business” or for “investment.” If you are selling a rental property you will often exchange into another rental property but you do have other options.

The day you close on your Relinquished Property starts the timing periods of the exchange process. You have a 45 day period after closing to identify a replacement property or properties. You have the earlier of 180 days after closing or the due date of your tax return to complete your exchange. Except for a presidentially declared disaster, there are no extensions of these two time periods. If you close in October or later in the year you can obtain an extension for the filing of your tax return to a date after the 180 day period (see “6 Rules for Structuring 1031 Exchanges” below). The QI will notify you in writing of your critical 45 and 180 day dates and will assist you with answers to questions you may have about this process.

For more information, contact Coakley Realty online or give us a call at 301-340-8700.

and commercial real estate

How Do You Start the Exchange Process?

The QI needs two things:

- A Purchase Sales Agreement (can be emailed or faxed to the QI). Your Broker/Agent must include language similar to the following in the contract or as an addendum:

Notwithstanding anything herein to the contrary, Seller shall be free to assign Seller’s rights under this Agreement to Exchange Solutions Group, LLC, (“ES Group”) as qualified intermediary for the Seller, and ES Group shall be permitted to sell the Property as part of a like-kind exchange under Section 1031 of the Internal Revenue Code. Purchaser/Buyer shall reasonably cooperate with Seller and/or any permitted assignee in order to complete the sale of the Property as part of an I.R.C. §1031 exchange, provided Purchaser/Buyer shall not incur any additional costs or liabilities associated with such an exchange, nor shall closing be delayed on account of such exchange.

- A completed Exchange Information Form (provides the name of Exchangor, tax ID number of Exchangor, sale price, closing date, exchange proceeds, closing attorney or title company’s contact info)

Have questions? Coakley Realty can help. Call us at 301-340-8700.

What to Expect?

The Exchange process:

- Before you close on your sale, the QI must be involved in the process.

- Upon receiving the purchase-sales-contract, application, and title information, the QI will draft the exchange documents that are required by the IRS:

- The Exchange documents usually contain:

- Exchange Agreement: This is the contract between you and your Qualified Intermediary. It is required by the IRS, and it defines the exchange terms and time frames.

- Assignment: Transfers to the QI the right to act on your behalf in the exchange of the property.

- Notice of Assignment: Notifies the Buyer of your Relinquished Property that you are doing a 1031 exchange. Must be sent to the Buyer before or at closing. The Buyer usually will sign this document acknowledging and consenting to the Exchange.

- Instructions for the closing agent: The QI sends this letter which gives the closing agent detailed instructions about preparing their documents for the closing, and how to handle each of the Exchange documents. It also includes wire instructions so that the funds can be wired to your Exchange account.

- Identification Form: As noted above, you have 45 days from the date of the closing on your Relinquished Property to identify a Replacement Property or Properties. The QI will assist you in this process.

- The Exchange documents are sent to you, your attorney, and/or the closing agent prior to closing.

- The Exchange documents usually contain:

- Settlement Statement for the Sale (often a HUD-1 form):

- The settlement statement will list the Seller as the QI as Qualified Intermediary for you. You will also sign as approving the transaction.

- The net sale proceeds will be shown as “Exchange Proceeds” on the settlement statement and will be sent to the QI by the closing agent. Unless you are taking proceeds from the closing (which you will pay tax on), the settlement statement will reflect that no money is coming to you.

- The QI’s Exchange Fee will be shown on your settlement statement and can be paid out of your sale proceeds.

- Secure Funds: Your exchange proceeds are wired to a segregated account under your name that tracks your tax ID number, earns interest, and is never co-mingled with other assets. Any distribution from your Exchange account requires two signatures, one from the QI requesting the wire (or, rarely, a check) and a second from you or your authorized representative.

- Replacement Property: Once you’ve signed a contract for the purchase of an IDENTIFIED Replacement Property, let your QI know, and email or fax the real estate contract to the QI. Your Broker/Agent must include language similar to the following in the contract or as an addendum:

Notwithstanding anything herein to the contrary, Purchasers/Buyers shall be free to assign their rights under this Agreement to Exchange Solutions Group, LLC, (“ES Group”) as qualified intermediary for the Purchasers, and ES Group shall be permitted to purchase the Property as part of a like-kind exchange under Section 1031 of the Internal Revenue Code. Seller shall reasonably cooperate with Purchasers/Buyers and/or any permitted assignee in order to complete the purchase of the Property as part of a 1031 exchange, provided Seller shall not incur any additional costs or liabilities associated with such an exchange, nor shall closing be delayed on account of such exchange.

- Earnest Money Deposit: You may supply the earnest money deposit for the Replacement Property contract. This is common and is often simpler in this fast paced market. If you need to use exchange funds for an earnest money deposit for your Replacement Property, then let your QI know. The QI needs an executed copy of the contract and wire instructions for the deposit. Upon receipt, the QI will email an Earnest Money Request Form and 1031 Assignment to you. Upon receipt of the signed 1031 Assignment and Request form, the QI will be able to wire the requested funds to the deposit holder (not to you—remember, you cannot touch your money or your exchange is disallowed).

- Replacement Property Closing: Please let the QI know as soon as possible who the closing agent is and their contact information—the QI will take it from there! When it’s time for closing on the Replacement Property, the closing steps outlined above for the Relinquished Property (Assignment, Notice, Closing Instructions, etc.) will again occur. On the date of closing, the QI will wire your exchange proceeds to the closing agent.

- Settlement Statement for the Purchase (also often a HUD-1 form):

- The settlement statement will list the buyer as the QI as Qualified Intermediary for you. Once again, you will sign as approving the transaction. The funds from your exchange account will be transferred by the QI to the closing agent (usually by wire) and will show in the body of the settlement statement as Exchange Proceeds. The balance of funds, if any, necessary to purchase the property will show at the bottom of the Purchaser (sometimes call “Borrower”) column as “Balance due from Buyer.” You will need to arrange with the settlement agent to provide this amount for the closing in the form of a wire transfer or as a cashier’s check.

- The End: Once you’ve closed on your purchase(s) your exchange is completed. Congratulations! Remember to retain copies of all of your Exchange documents as well as your settlement statements and deeds for all transactions. You will be required to file a Form 8824 with your tax return.

Contact Coakley Realty online or give us a call at 301-340-8700 for more information.

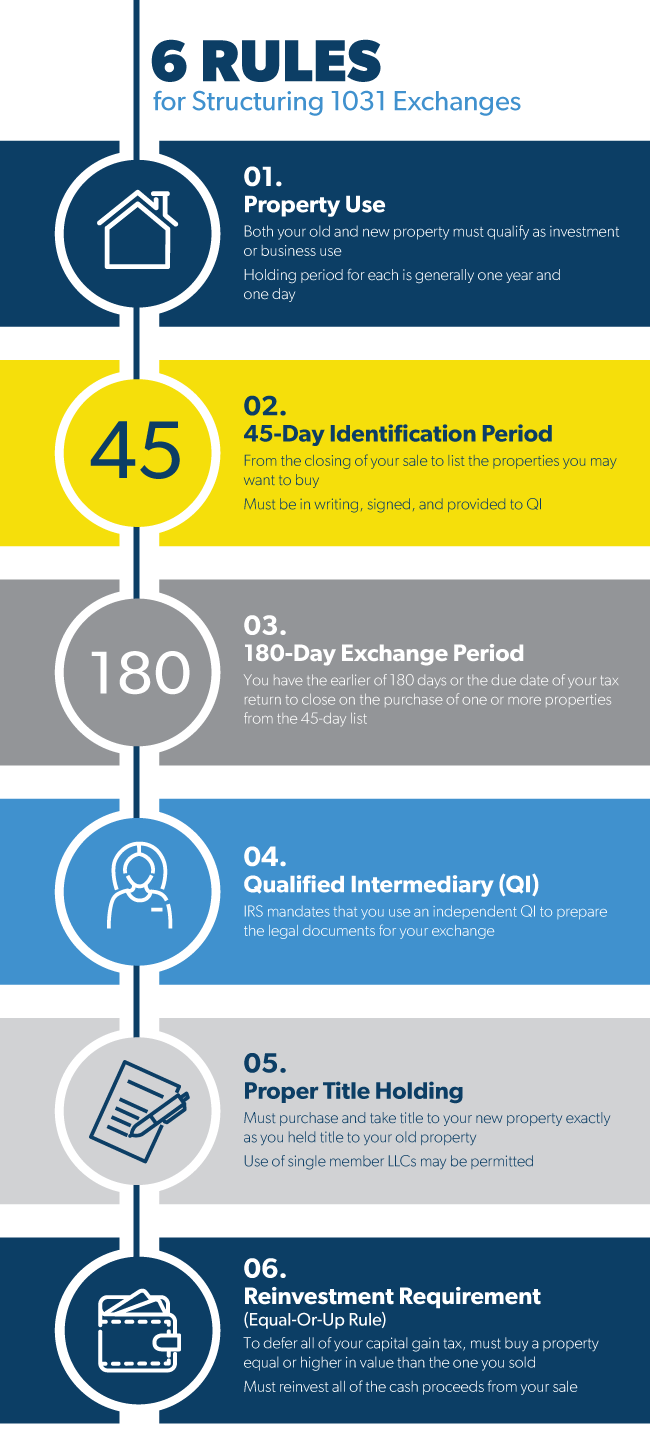

The 6 Rules for Structuring 1031 Exchanges

Learn more below:

- Property Use: Both your old and new property must qualify as investment or business use. If both properties pass this qualification test, you can exchange nearly any type of real property and equipment. The holding period for each is generally one year and one day.

- 45 Day Identification Period: You have 45 days from the closing of your sale to list the properties you may want to buy. This must be in writing, signed, and provided to Q.I. before end of 45 day period. NO EXTENSIONS.

- 180 Day Exchange Period: From the sale closing date, you have the earlier of 180 days or the due date of your tax return to close on the purchase of one or more properties from the 45 day list, thereby completing your exchange. If you close in October or later in the year you can obtain an extension for the filing of your tax return to a date after the 180 day period.

- Qualified Intermediary (QI): The IRS mandates that you use a QI to prepare the legal documents for your exchange—the QI must be independent—it cannot be your spouse or other restricted relatives, employee, broker, real estate agent, accountant or attorney. The QI is the neutral 3rd party facilitator of your exchange.

- Proper Title Holding: Generally you must purchase and take title to your new property exactly as you held title to your old property. The use of single member LLCs may be permitted.

- Reinvestment Requirement (or the Equal-Or-Up Rule): To defer all of your capital gain tax, you must buy a property equal or higher in value than the one you sold. And, you must reinvest all of the cash proceeds from your sale.

FAQs About the 1031 Tax Exchange

If you’re considering taking advantage of the 1031 tax exchange, you may have some questions. Here are some common questions and their answers for your consideration.

Do I Have Qualified Property?

If you have a property that is used in trade or business and is productive, you can exchange for like-kind property. Like-kind, in this case, refers to the type of property use. So, if you have a single-family property that is an investment property, and wish to exchange it for a multi-family unit, you can. However, you can’t use the 1031 tax exchange to trade property for “stock in trade.” This can refer to houses built by developers or fixer-upper properties that an investor has flipped, as well as shares, stocks, bonds, and similar investments.

Do Vacation Homes Fit These Stipulations?

Sometimes vacation homes fit within the parameters of qualified property. If the home is rented to another person for 14 days of each month for at least 24 months, then it can qualify. You also must limit your own use of the property to either 14 days a year or 10% of the total time you have it rented for the calendar year. This is a complex exception to the 1031 tax exchange, so it’s best to talk to your Facilitator or a tax attorney about your options.

Are Any Types of Property Excluded from the 1031 Exchange?

Yes. The following types of property are excluded:

- Stocks

- Bonds

- Notes

- Securities

- Interests in partnerships

In addition, if a property is held for the goal of sale, it is excluded. Business inventory is a common example of this, but in real estate, properties purchased with the intent to flip and sell are excluded. Also, the business must be used for business or investment, so your personal home would not qualify.

Are There Time Limits Involved?

Yes. If you choose to use the exchange process, you have 45 days from the time of closing on the relinquished property to name your potential replacement properties. You also have 170 days from closing to actually making the acquisition of the new property.

How Can I Identify the Replacement Properties?

Identifying the replacement properties requires what’s called an unambiguous description of the property. This can be an address or a legal description of the property. You are allowed to name more than one in this process. You can:

- Identify three or fewer properties, with the intent of purchasing one of them.

- Identify four or more properties, provided the value doesn’t exceed 200% of the market value of the property you’re exchanging.

- Identify four or more properties that do exceed 200% of the exchanged property, understanding you must acquire 95% of the market value of all of the properties.

About Exchange Solutions Group, LLC

Exchange Solutions Group, LLC (ES Group) is a Qualified Intermediary and, by definition, is not a fiduciary. By law, ES Group cannot and does not provide legal or tax advice. The information contained in this document is general in nature and briefly covers a very complex subject. You may not rely on the information contained herein for legal or tax purposes and should consult your independent legal and/or tax advisors.

For more information, please contact William J. Gessner, Esq. (MD), Managing Member of Exchange Solutions Group, LLC

Email: Gessner@1031esgroup.com

Direct: 703-787-3893

Cell: 301-651-3445